What Is Carriage Inward?

Carriage Inward is the cost the buyer uses to transport the ordered goods to their business place. It is a major expenditure that constitutes the total cost of procurement and ensures precise inventory valuation and cost recording. Knowing the carriage inward meaning is essential in recording the inventory value and determining the overall cost of purchases in financial accounts.

What are the Alternate Names for Carriage Inward?

Carriage Inward is also referred to as freight-in and transportation-in, particularly in terms of accounting and logistics. These terminologies are important in pointing out the costs incurred in carrying products supplied by suppliers to the place where the buyer will keep them as inventory or to sell.

The Role of Carriage Inward in Purchasing and Inventory Valuation

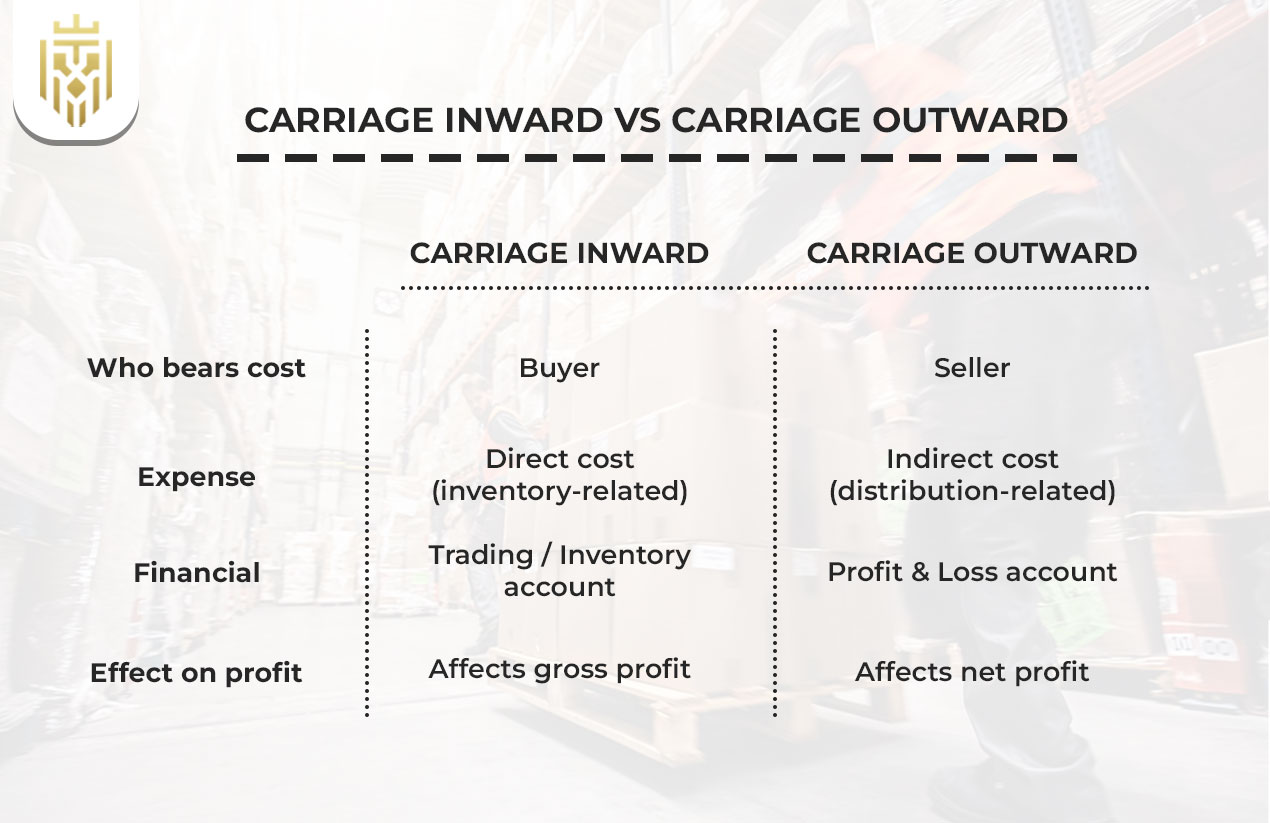

The accounting records Carriage Inwards and Carriage Outwards separately, where inward costs add to the value of the inventory, whereas outward costs are considered as the selling costs. This will make the valuation accurate and the calculation of procurement costs precise.

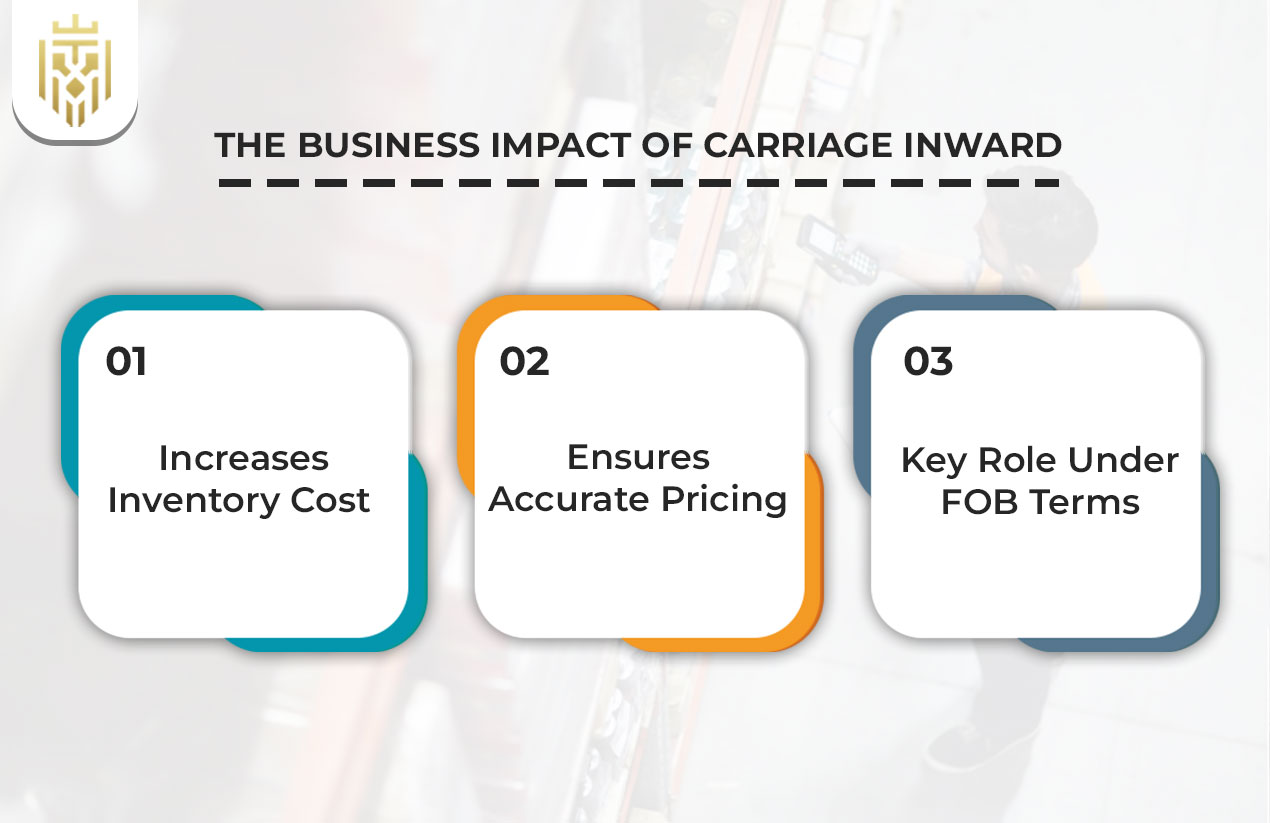

The Business Impact of Carriage Inward

Businesses should monitor these costs carefully as a way of ensuring that there are proper inventory records and that there is open bookkeeping. A Carriage Inward is an addition of cost to produce a higher cost of goods when used as part of the inventory valuation.

Increases Inventory Cost

A Carriage Inward is an addition of cost to produce a higher cost of goods when used as part of the inventory valuation. Businesses know that what is Carried Inwards can help them in estimating their gross profit and also in reporting costs of sales well.

Ensures Accurate Pricing

Adding the inward carriage costs to inventory makes the business calculate the actual landed cost of all the products. This enables better pricing as well as cost control in different product categories.

Key Role Under FOB Terms

In the case of businesses that apply FOB shipping, inbound carriage charges are the customer’s costs of shipping. Identification of these costs would denote proper financial reporting in terms of various trade and shipping contracts.

How is Carriage Inward Accounted For?

The accounting treatment does not treat Carriage Inward and Carriage Outward in the same way; one is the cost of inventory on the inventory account, and the other is an expense of sale, which is on the selling accounts. The earmarking leads to proper profit and loss determination.

Direct Expense or Capitalised Cost

Carriage Inward can be a direct expense or capitalised as carriage on inventory. The proper accounting treatment is determined by the specifics of whether the cost is associated with the resale of goods or the acquisition of assets.

Add to Cost of Sales

In cases where a purchase is made of goods to be resold, the Carriage Inward cost is taken to the cost of goods sold (COGS). This makes sure that the total purchase cost is what amounts to the total cost of carrying products to the business.

Capitalise as Asset Cost

When a Carriage Inward comes under the category of fixed assets, then the cost would be capitalised and added to the asset value. Subsequently, this cost is spread over the asset’s useful economic life through depreciation in the appropriate recognition of expense.

Sample Journal Entries

Journal entries are vital in recording entries inward to ensure proper bookkeeping. Debit and credit entries help businesses to record these costs as trading, asset, or inventory costs.

Debit Inward, Credit Cash

A normal entry made by business firms would be crediting Carriage Inward or inventory and debiting cash or accounts payable when purchasing goods. This will make the cost a component of the final inventory value.

Transfer to Inventory Accounts

Carriage Inward balances, at the close of an accounting period, are moved to trading or inventory accounts. This invention is necessary to correct the inventory valuation on the financial statements.

Carriage Inward vs. Carriage Outward

Carriage Inward and carriage outward are two widely separated costs in accounting. Carriage Inward is an expense the buyer bears as a direct cost that adds to inventory and gets accounted for in the trading or inventory account and affects gross profit. Outward carriage by the seller is an indirect distribution cost charged to the profit & loss account and impacts net profit.

Practical Scenarios

Under an ordinary purchase, a ₹100 product with ₹6 Carriage Inward will have a sum of the inventory value at ₹106. This situation is a pointer to how Carriage Inward directly adds to the cost of the inventory used in pricing and the calculation of gross profit. Likewise, in the case of capital assets such as machinery, the full cost comprises both transporting goods and the purchase price and installation costs.

Why Accurate Carriage Inward Tracking Matters

![]()

Accurate tracking of Carriage Inward expenses enable the firms to assess actual costs of procurements, enhance their profitability, and make accurate financial reports. By not doing this, the management of the inventory can become mispriced, leading to a decrease in the profit margins.

Ensure Profit Margin Accuracy

When recorded, Carriage Inward should be properly recorded to ensure that there are no counting errors on the profit margins. The distortion of the gross profit can mislead the analysis of the performance due to the misclassification of such costs.

Prevent Inventory Undervaluation

The inclusion of Carriage Inward costs help in the valuation of inventory, and this helps to avoid the understatement of total assets. Inward meaning is related to incoming costs, which must be identified in order to get correct asset pricing.

Strengthen Cost Transparency

Achieving a higher level of cost management and control is advanced by tracking Carriage Inwards, which helps in highlighting all the concealed logistics costs. Open accounting improves the disclosure of financial reports and the trust of the investor.

Common Pitfalls & Best Practices

Inventory misevaluation may arise in cases of misclassification of Carriage Inward as part of the normal operating expenses. To prevent such errors and have the correct financial records, businesses ought to observe well-defined accounting rules.

Risk of Overlooking Small Transport Charges

Smaller transportation fees may seem unimportant, but they can accumulate tremendously over the years. The suppliers’ invoices prepared by companies should be thoroughly checked so that all Carriage Inward expenses that need to be covered are captured.

Misclassifying Asset-Related Carriage versus Operating Expenses

Carriage received against fixed assets is to be capitalised instead of being charged. Incorrect classification of these accounting expenses may skew the values of the assets and cause mismeasurements when depreciation is charged.

Best practices

When recording Carriage Inward, always do it along with the first sale entry to keep accurate records. It is important to clearly distinguish between inventory-based and asset-based costs and regularly reconcile and audit the accounts in order to keep a good track of the records and maintain financial clarity.

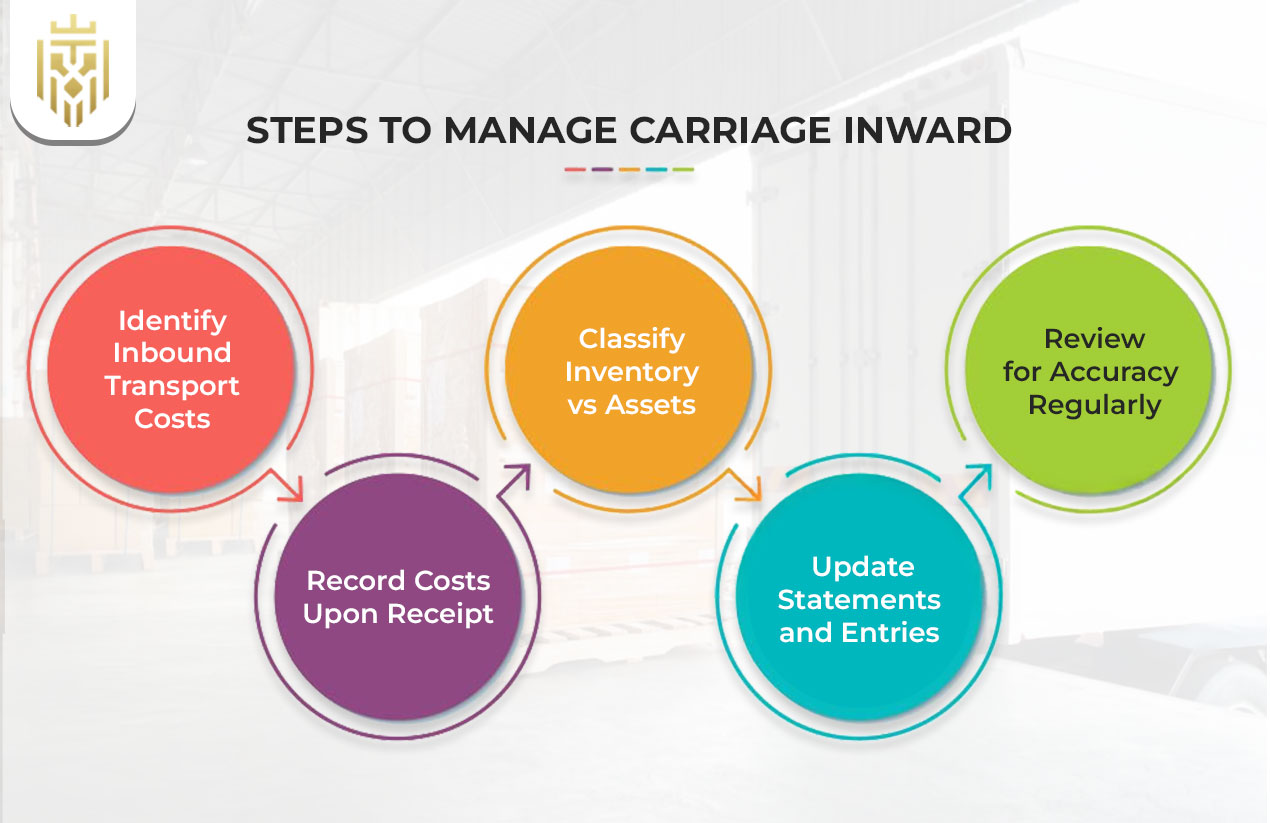

Step-by-Step Guide for Managing Carriage Inward

A well-organised Carriage Inward tracking method will ensure that cost accounting is comprehensive. Here, the procedure is to identify, record, classify, and review all costs associated with the transport of incoming goods.

Identify Inbound Transport Costs

Businesses must determine all the expenses that will be incurred in moving the shipment between the supplier and the warehouse. These prices entail the amount of freight, loading and unloading, and any other additional handling policies.

Record Costs Upon Receipt

Carriage Inward costs are recorded once the goods have been received to enable proper maintenance of inventory and expenses. Financial statements may be affected by discrepancies due to a delay in entries.

Classify Inventory vs. Assets

It is critical to do the right classification. Carriage Inward of resalable goods goes into inventory, whereas costs involved in making purchases of assets are capitalised to account for depreciation in the future.

Update Statements and Entries

Carriage Inward compensations should be represented in accounts and final entries. This makes sure that the calculation of total inventory cost and gain is precise and up-to-date in time.

Review for Accuracy Regularly

To identify the missing/misclassified costs, regular auditing of Carriage Inward entries shall be conducted. The accounting standards are also followed when periodic reviews are performed, as they enhance financial transparency.

FAQs

1) Is Carriage Inward always a direct expense?

Carriage Inward is typically the direct cost of buying stock inventory, but when involving the purchase of assets, it is capitalised and not considered as an immediate cost in computing profits.

2) Can Carriage Inward ever be expensed outright?

Yes, Carriage Inward may be expensed directly when it possesses a close association with the inventory that is being sold in the period and would actually be included in the cost of goods sold and not be capitalised as an asset.

3) How does Carriage Inward affect profit margins?

Carriage Inward increases the overall cost of inventory, ultimately increasing the cost of goods sold, and can decrease gross profit margins unless properly factored into pricing strategies.

4) Should Carriage Inward on assets be capitalised?

Yes, the Carriage Inward on capital assets should be capitalised, i.e., it should be added to the cost of the asset and depreciated in the statement of finance instead of expensed in the income statement.

5) What is the main difference between Carriage Inward and carriage outward?

Carriage Inward has to do with the costs of the inventory of a buyer, and costs are calculated on the gross profit. Carriage Outward is a cost of a distributor, and it is recorded in the profit and loss account, which affects the net profit.

6) What is Carriage Inwards?

Carriage Inwards is a transport cost incurred by a buyer to transport goods to the buyer’s place. It is usually taken into account in the inventory valuation to have correct cost accounts.