What Is Carriage Outwards?

Carriage outwards means a delivery expense paid to convey goods from the seller to the buyer. Carriage outwards is an expense that is incurred after sale, whereas carriage inwards are expenses incurred before the sale. This expense is generally not absorbed by the buyer unless it is billed separately. Hence, it is recorded as a selling or distribution expense rather than a cost of sales and directly affects the bottom line of a business.

What is carriage outwards also known as?

Carriage outwards has become synonymous with delivery charges, freight out, or outward freight. These terminologies are found to be used interchangeably in bookkeeping and accounting software. This includes expenses for fees charged by third-party carriers, internal transport charges, and fuel costs for carrying out the delivery.

Role of carriage outwards in business operations and financial reporting

Every business views carriage outwards as a necessary expenditure to maintain client satisfaction and prompt delivery under day-to-day operations. For financial reporting purposes, it is important to ensure that all carriage outward expenses are properly accounted for so profit margins may be correctly shown in the financial statements.

Why Tracking Carriage Outwards Matters

Understanding its impact goes beyond just numbers—here are some key reasons why tracking carriage outwards is essential.

Directly affects net profit as an operating expense

Since carriage outwards is an operating expense, it also reduces net profit on the income statement of a company. It is different from costs-of-goods-sold, which come in the metric of gross profit, and delivery costs are taken from the gross profit value.

Plays a role in setting product pricing and delivery fees

Knowing how much it costs to deliver a product allows companies to price accordingly. Businesses might include this cost in the product price or charge separately for delivery.

Helps monitor distribution efficiency and manage costs

Rising delivery costs may point to inefficiencies in routing, poor negotiations with carriers, or increasing fuel prices. Regular monitoring allows for timely interventions and operational improvements.

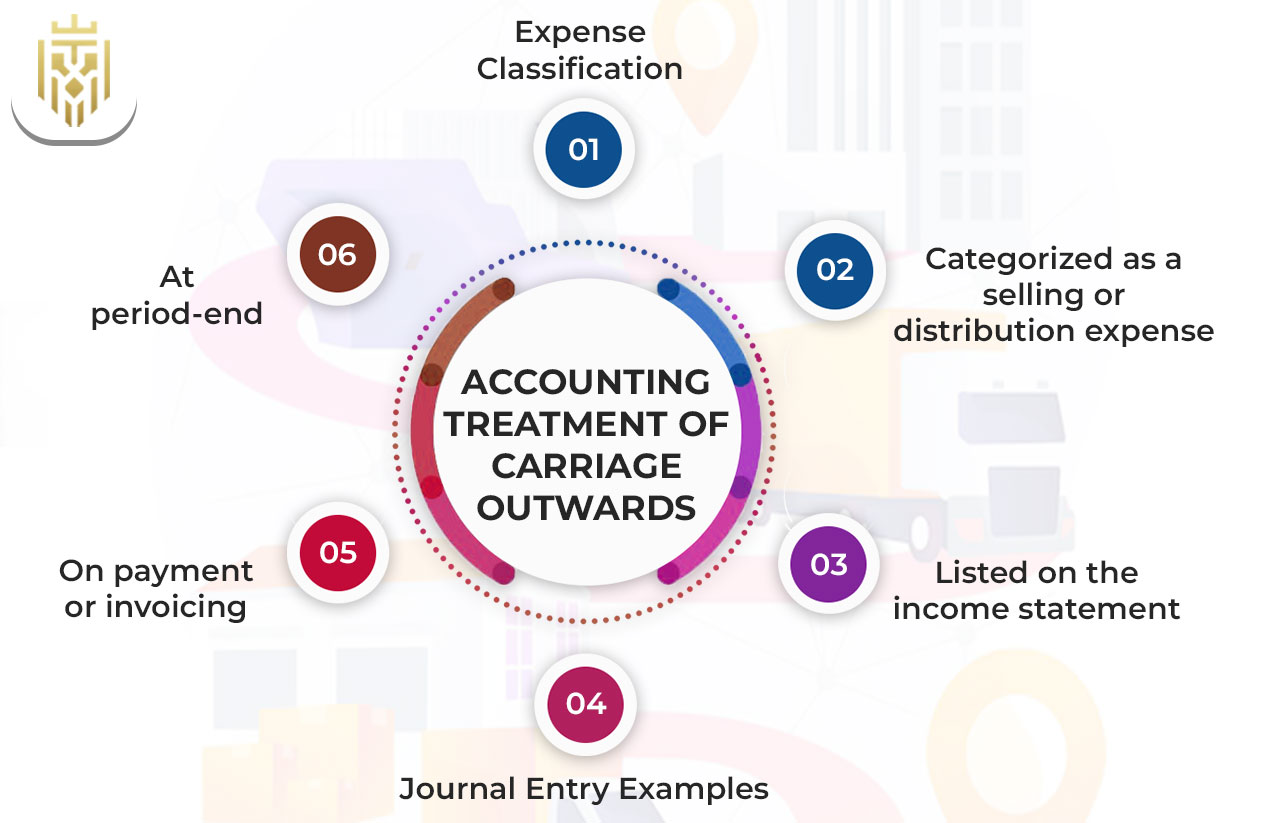

Accounting Treatment of Carriage Outwards

When it comes to bookkeeping, carriage outwards needs specific handling—here’s how it’s usually recorded and classified.

Expense Classification

Carriage outwards is an operating expense. More specifically, it is considered a selling or distribution expense since it is incurred after the point of sale and occurs as a means to bring the product to the customer.

Categorised as a selling or distribution expense

Such a classification distinguishes carriage outwards from direct expenses, which are usually production or purchasing expenditures. Hence, bearing the cost of carriage outwards is concerning and being grouped with selling expenses such as marketing, packaging, and commissions.

Listed on the income statement rather than as part of cost of goods sold

Carriage outwards is shown in the financial statement below gross profit, under operating expenses. It is never put into the category of cost of goods sold because it is not an expense that directly relates to the cost of production or acquisition of the goods.

Journal Entry Examples

When delivery is paid for or invoiced, the accounting entry reflects it as an expense. The carriage outwards account is debited, and either cash or accounts payable is credited depending on whether the payment is immediate or due later.

At the end of an accounting period, the accumulated delivery expenses are transferred to the profit and loss account to reflect the true operating costs for that period.

Real-World Examples

Example 1:

The retail outlet sells to a customer; it pays out ₹500 to the courier service for delivering the products. That amount is immediately capitalised as carriage outwards expenses in the books.

Example 2:

At the month’s end, the company goes over accounts, paying attention to how much was spent on deliveries during the period, and, being able to establish that amount, it finds delivery expenses amounting to ₹18,000 in the income statement as distribution expenses in the calculation towards net profit.

Benefits of Accurate Carriage Outwards Tracking

![]()

Keeping close tabs on delivery costs brings real advantages—here are some of the most important ones.

Ensures precise calculation of net profit

Accurate recording of carriage outwards ensures that the profit reported remains realistic as per actual expenses. Misreporting can either overstate or understate financial performance.

Helps identify and reduce delivery cost inefficiencies

Delivery expense trends may point out hidden problems such as inefficient delivery routes, inefficient use of shipping volume, or underperforming carriers. Catching these early reduces waste and improves margin.

Informs pricing strategy and carrier negotiations

Information on carriage outwards enables better decisions on pricing and negotiating contracts with carriers. It also helps make sure that the delivery charges passed on to the customers are fair and at par with the market.

Common Pitfalls & Best Practices

It’s easy to go wrong with how carriage outwards is handled—here are some common mistakes and what to do instead.

Misclassifying delivery as cost of goods sold

This mistake inflates gross profit and can lead to poor decision-making. Since carriage outwards is not part of acquiring goods, it should never be grouped under cost of goods sold.

Delaying recording of delivery expenses

Failing to record delivery costs promptly can distort monthly or quarterly financial reports. Delays can also make it harder to trace back issues or irregularities.

Best practices:

Getting carriage outwards right takes consistency—here are a few practices that help keep your process sharp and accurate.

Record carriage outwards as soon as goods are dispatched.

Accounting for these expenses at the time of dispatch keeps your accounts current and accurate.

Maintain a dedicated ledger or expense account

Having a separate carriage outwards account simplifies the tracking and reporting, thus smoothing the review and auditing of your finances.

Review delivery expenses relative to sales regularly.

Looking at the cost of delivery versus sales over a period of time will give you a clue as to whether the cost of delivery is exceeding sales and when you need to look into your logistics strategies.

Step-by-Step Guide to Managing Carriage Outwards

Being in full control of your delivery charges shouldn’t be difficult. Here is a basic guideline to help you manage this efficiently.

Capture delivery cost as each sale is made.

For every sale and shipment of goods, a system entry for delivery charges should be done. Backlog situations are thereby avoided, and the recorded information is always current.

Enter the expense immediately in accounting records.

Maintaining transparency becomes easier with real-time entry, as does the timely view of the company’s finances, each of which is essential to strategic planning.

Track and summarise monthly or quarterly

Tracking and summarising on a monthly or quarterly basis reveals trends; this facilitates budgeting and enhances decision-making.

Compare delivery cost against revenue and delivery volume

Delivery cost per sale or per unit delivered helps in determining whether the logistics operation is economically viable or needs improvement.

Use insights to optimise logistics or adjust pricing.

Based on the data, realisations help switch carriers, change delivery zones, or change price models for the best balancing of service and cost.

FAQs

1) Is carriage outwards included in the cost of goods sold?

No, carriage outwards is not part of the cost of goods sold. It constitutes a separate operating expense and is accounted for after gross profit.

2) Can carriage outwards be charged to customers?

Yes, businesses may sometimes pick up delivery charges or pass them on to customers, either directly or indirectly by incorporating such charges into the price of the product.

3) Does carriage outwards impact gross profit?

No, it impacts net profit only; gross profit is computed before delivery expenses are deducted.

4) Can carriage outwards ever be capitalised?

Very rarely, it could be capitalised where the delivery relates to the construction of a fixed asset; however, in normal sales situations, it should be treated as an expense.

5) What’s the main difference between carriage inwards and outwards?

Carriage inwards pertains to the cost of moving goods into a business and thus forms part of the cost of goods sold. Carriage outwards is the cost of sending goods to customers and is treated as a selling expense.

6) What is carriage outwards?

It is an expenditure borne by a business in sending goods to customers after sale. Accounting-wise, it is recorded as selling or distribution expenses.